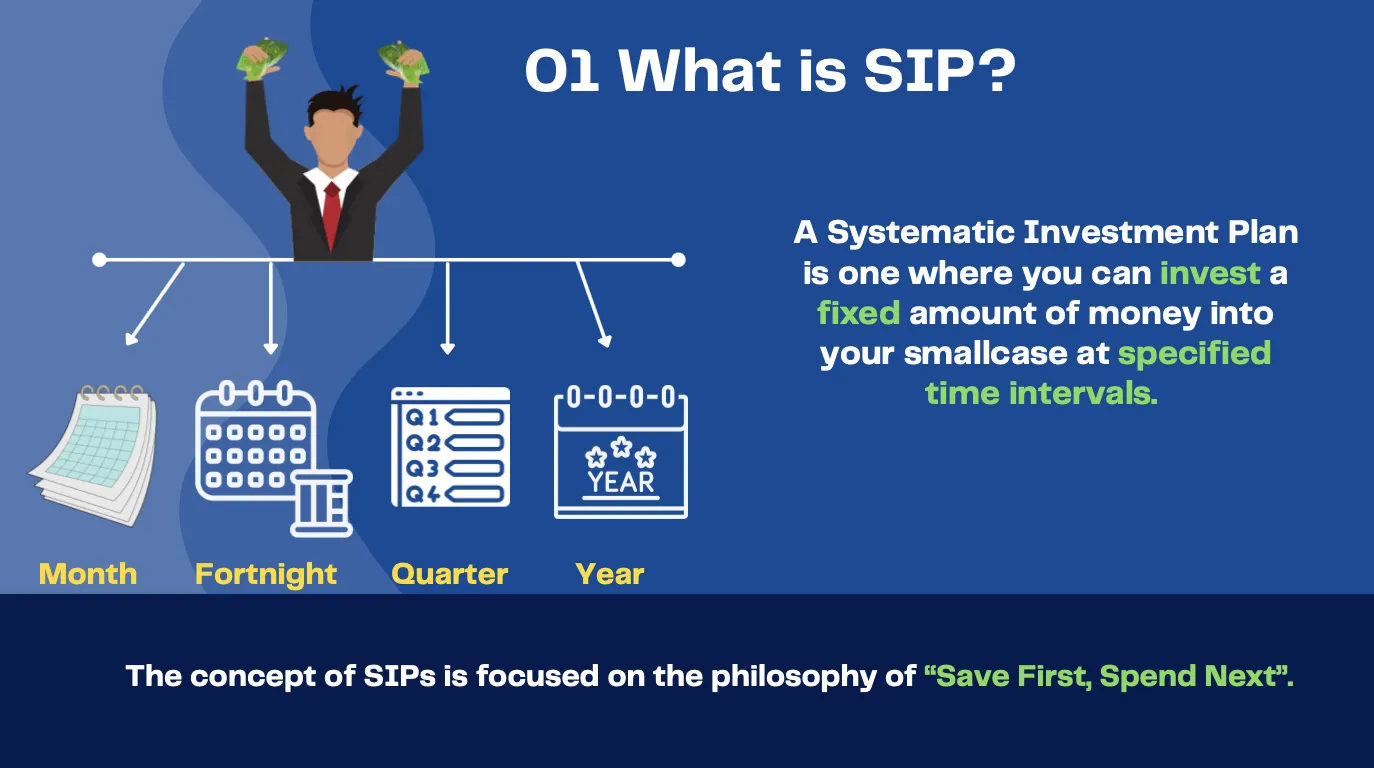

If you’re new to investing, you’ve probably heard the term SIP many times. SIP stands for Systematic Investment Plan, and it has become one of the most popular ways for Indians to invest in mutual funds. But what exactly is SIP, and how does it work? Let’s break it down in simple terms.

What is SIP?

A Systematic Investment Plan is a method of investing a fixed amount of money at regular intervals, usually monthly, into a mutual fund scheme. Rather than investing a large lump sum at once, SIP allows you to build your investment gradually over time.

How Does SIP Work?

When you start an SIP, a fixed amount is automatically deducted from your bank account every month and invested in your chosen mutual fund. In return, you receive units of the fund at the prevailing Net Asset Value (NAV).

Because markets move up and down, you end up buying more units when prices are low and fewer units when prices are high. This is known as rupee cost averaging, which helps reduce the risk of market volatility.

Why Choose SIP?

1️⃣ Start Small: You can start with as little as ₹500 per month.

2️⃣ Convenient & Automated: No need to remember dates; money is auto-deducted.

3️⃣ Disciplined Investing: Builds a habit of regular savings.

4️⃣ Power of Compounding: The longer you stay invested, the higher your returns.

5️⃣ No Market Timing Needed: Removes the stress of guessing the right time to invest.

Who Should Invest Through SIP?

- Salaried professionals

- Small business owners

- Students who want to start early

- Anyone looking for disciplined, long-term wealth creation

Conclusion

SIP is one of the most beginner-friendly and effective ways to invest in mutual funds. By investing small amounts regularly, you can create a significant corpus over time without feeling the burden.